Unlocking the Power of a Self-Directed IRA: Take Control of Your Retirement Investments

Believe it or not, you can invest in real estate, promissory notes, precious metals, cryptocurrency, mineral rights, tax liens, and even raw land with a self-directed IRA. If your broker claims this is off-limits, they're simply mistaken.

A true self-directed IRA, whether traditional or Roth, is a retirement account where you have the control. Learning how to self-direct an IRA is crucial because it allows you to invest in much more than just what Wall Street offers. That's right—you get to decide where to invest your money, not just in stocks, bonds, mutual funds, or annuities.

What Can You Invest In?

Your broker might tell you that you can’t do this and try to prohibit you from it. They’re either misinformed or not telling the full truth. With a self-directed IRA, you can invest in a variety of assets such as:

Real Estate - including but not limited to: Tax liens, Rental properties & Real estate development projects

Promissory notes

Private Company Stock

Precious metals

Mineral rights - water, oil, gas

Cryptocurrency

Livestock

IP Patent Interest

And much more!

Why Doesn’t My Brokers Promote This?

Many investors wonder, “Why haven’t I heard of self-directed IRAs or self-directed 401(k)s before?” The answer is simple: large financial institutions, the ones that control most U.S. retirement accounts, don’t make as much money from self-directed strategies. They steer you toward products that generate high commissions and fees for them.

Restrictions on Investment Options

Surprisingly, the list of what you can't invest in with a self-directed IRA is short. You are restricted from investing in:

Collectibles (like art, stamps, coins, alcoholic beverages, or antiques)

Life insurance

S-corporation stock

Any investment that constitutes a prohibited transaction

Investments not allowed under federal law (e.g., a marijuana dispensary)

This means you have much more control over your retirement accounts than you might think. You can get a tax deduction in your business to fund your retirement accounts and invest those accounts creatively to build your financial freedom. This is a key strategy for diversifying your wealth.

Real-Life Example

I’ve helped clients across the country set up their self-directed IRAs, often with an LLC. This setup allows investors to control an LLC owned by their self-directed IRA and start investing immediately.

Client Example: The client invested in undeveloped land through their self-directed IRA, anticipating the construction of a major highway nearby. Their investment of $120K grew to over $1.5 million as the land value skyrocketed.

Avoiding Prohibited Transactions

When self-directing your retirement account, it's essential to be aware of prohibited transaction rules, which your financial advisor might use to scare you off. However, these rules have been in place for over 30 years, and investors have successfully used self-directing strategies to build significant wealth.

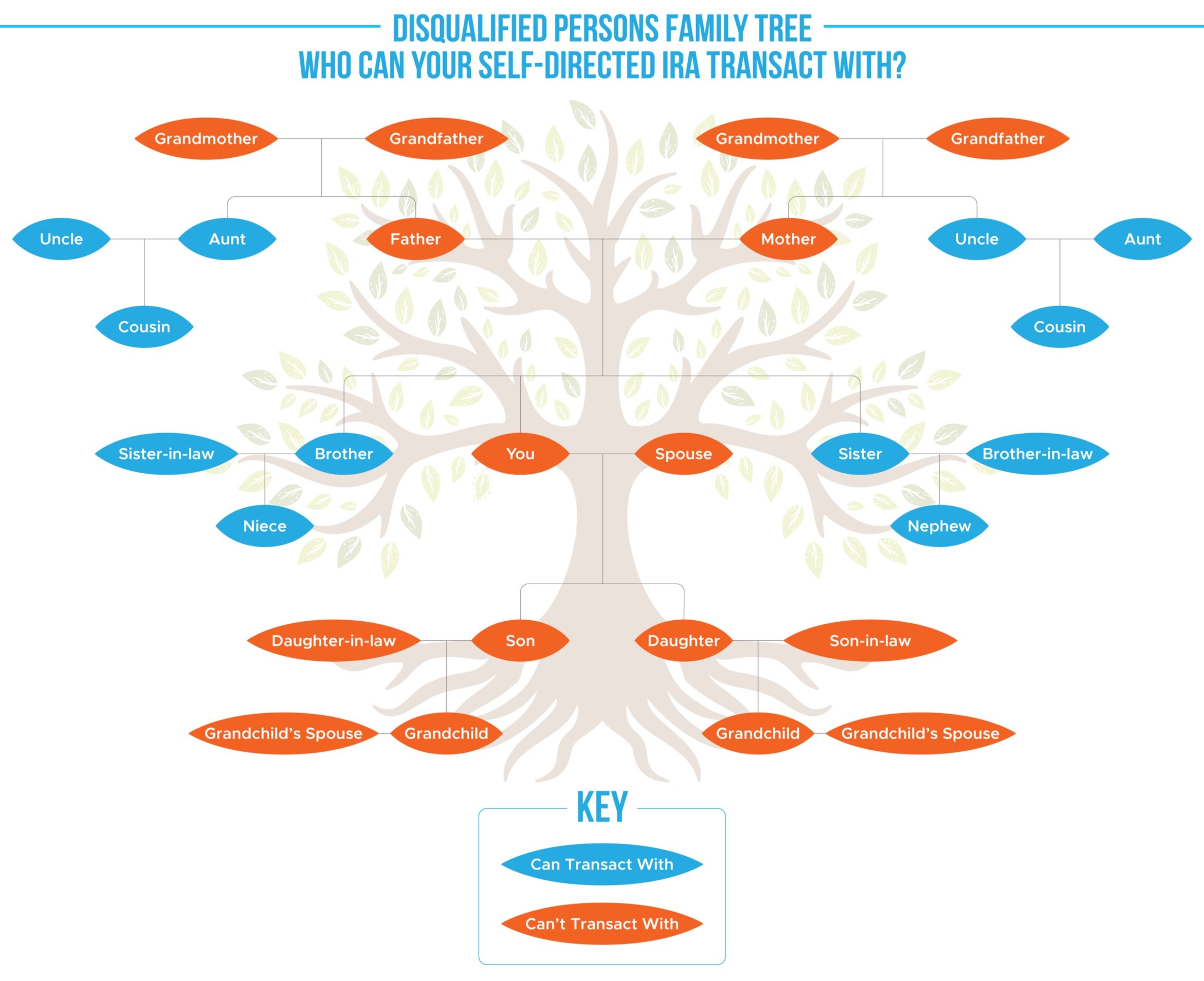

The prohibited transaction rules, outlined in Internal Revenue Code 4975 and the Employee Retirement Income Security Act (ERISA), restrict your IRA from engaging in transactions with disqualified persons, such as:

You, the account owner

Your spouse

Your children or parents

Certain business partners

For example, your IRA cannot buy a rental property owned by your father. However, it can hold the property strictly for investment purposes and lease it to unrelated third parties.

Self-Directed Accounts Expanded

IRAs are not the only type of retirement account that can be self-directed. In fact, self-directing is not limited to just retirement accounts.

Retirement Accounts

401(k) - including Solo-401(k) and Roth 401(k)

IRA - Traditional, Roth IRA, SEP IRA, Inherited IRA, SIMPLE IRA

Health and Medical Accounts

HSA

401(h)

Education Accounts

ESA

Coverdell

Roth IRA (education expenses can be distributed from a Roth tax-free and penalty with caveats, seek expert advise)

Seek Expert Advice

While this article provides an overview, it's crucial to consult with a tax advisor who understands self-directed IRAs thoroughly. This ensures you stay compliant with IRS rules and avoid penalties. Remember, your IRA custodian or 401(k) administrator won't be liable for any mistakes—you will be.

Unlock the potential of your retirement accounts with a self-directed IRA and take control of your financial future today!

For more detailed guidance and to start setting up your self-directed IRA, feel free to reach out to me. Let's work together to make your retirement investments truly work for you.

I’d like to personally thank Mark J. Kohler and Mat Sorensen for their education and experiences contributing to the information in this article.